Tips to Teach Your Teen About Money and Credit

Steps to Help Your Teenager Build a Good Credit Score

Financial literacy is the ability to use knowledge and skills for making good money and spending decisions. Financial literacy covers a wide range of different financial topics starting from daily personal financial accounting skills to long-term personal financial planning for retirement.

Luckily, nowadays there are a lot of books and instructions that can help you deal with such problems. Although get $50 instantly app also can be an easy way to get quick cash when they need it. However, it is much better to transfer knowledge from one generation to another how not to get into debt.

If you have a child, it is essential to instill in him or her appropriate values, principles, and habits. If the future of your beloved daughter or son is not indifferent to you this article will be entirely beneficial for you.

As a parent, you should set a good financial foundation. It is essential to give them the necessary knowledge so that they can resolve their problems without your interference.

Make sure your child understands how to build a good credit score and will cope with this task in the future.

To make it possible a person must acquire valuable hands-on experience. The best way to do it is to be a great example for the following. Do you really know how to build a credit score that will make you feel calm and secure? If you have doubts about it, look at the following tips.

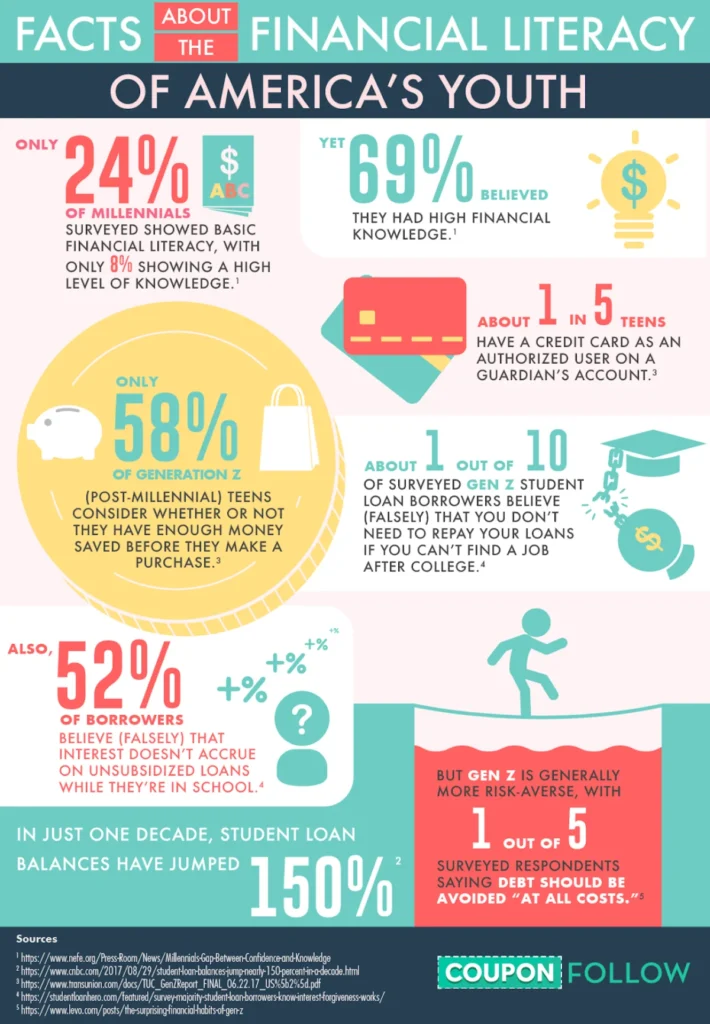

Studies on Financial Literacy

There are a number of investigations that have been conducted into the financial literacy of teenagers in the United States. The results of these studies have been mixed, with some finding that teens are generally financially literate and others finding that they lack basic knowledge in this area.

However, one thing that all of these studies agree on is that there is a significant portion of the teen population who are not adequately prepared to manage their finances. This lack of financial literacy can have serious implications for teens as they enter adulthood, so it is important for parents and educators to make sure that teens are getting the information and education they need to make sound financial decisions.

There are a number of ways to improve financial literacy, including providing education in schools and teaching teens about budgeting and investing. By taking steps to improve financial literacy among teens, we can help them to enter adulthood with the knowledge and skills they need to manage their finances effectively.

Don’t Miss the Payment Deadlines

If you want to repay your loan as fast as possible make sure you don’t miss the payments. Otherwise, it will lead to an increase in the interest rate and additional expenditures. By adopting the right habits you will inspire your children to do the same in the future. It will be a good idea to show your beloved how beneficial may be simple calendars in building a good credit score.

They may be both digital (mobile apps, platforms) and paper. By adding the payment dates you will be able to get push notifications and won’t miss the deadlines. It is essential for building a good credit score. If the question„ How to build my credit score wisely?“ arises, start with learning the financial nuances by yourself first. Only then you can teach someone else.

Basics First

You should understand that your child may see debit and credit cards for the first time. That is why don’t start with sophisticated themes. It will be great to open a banking account for your daughter or son. The first purchases should be done under your control. Deposit money on the banking card of your child and explain how to spend money wisely and avoid overdrafts or declined debit card charges.

Then you should step away and just observe his or her behavior. It is pivotal to allow making mistakes. It is the only way to “feel” money and get great financial education. Among other things, make sure your child understands the difference between debit and credit cards. For you, as an adult, it seems obvious but the things are not so simple for the youngest.

Let Your Child Earn Money

People appreciate the things that are difficult to achieve. If you want your daughter or son to understand how to build a credit score fast make sure she or he knows where to get money. If you want to teach your kids how to save money, reward them financially for doing household chores and other tasks.

Alternative Types of Money

Tell your children about (and, if possible, show) payment cards, traveler’s and collection checks, and other types of money. Don’t forget to explain that the resources in cards and checks are not unlimited. You still have to pay for all operations with real money that you have to earn.

Make Use of Useful Games

Do you know that some games can teach you how to build your credit score? It is one of the most effective methods for children. You can choose the best option due to your preferences but “Monopoly” is the most board game not only among children but adults as well. Among other beneficial options are Wise Pockets, Financial Soccer, H.I.P. Pocket Change, etc.

Warn About the Dangers

All offers to earn big, fast, and easy money on the Internet or from strangers are dangerous. If a child wants to earn extra money, it is possible, but first adults should check whether it is legal, whether it won’t interfere with their studies, and whether the child will have enough time to rest.

The child and parents will be able to achieve greater success and make far-sighted decisions if they take into account not only money but also other important resources such as time, health, knowledge, and environment.

Children’s Mobile Banking

In addition to a bank card, you can install mobile banking on your child’s smartphone so that he or she learns to control the balance of the account, analyze the expenses, and receive passive income in the form of interest from the bank for his savings.

Parents also have access to the child’s account in their application and can set limits or prohibit certain operations. For example, they can ban transfers to other cards or purchases on the Internet, and, if necessary, completely block the child’s account.

Final Thoughts

Financial education determines your standard of living. You may have a high salary but still have no savings or expensive purchases. It usually happens when a person lacks appropriate knowledge.

Luckily, nowadays people understand that it is essential to invest in financial education. If your parents didn’t do it you still have an opportunity to make the life of your child much easier. Start with yourself and provide your son or daughter with hands-on experience.