Trading Crypto | 2 Methods 2 Strategies + 1 Bonus

If you’ve been keeping tabs on the news, you may have noticed that there has been an explosion of interest in cryptocurrency trading. Whether it’s because of Bitcoin or another type of crypto coin (altcoin), more people than ever are looking for ways to invest and make money with their digital assets. But how do you get started trading crypto? Is it as simple as just buying some coins and hoping for the best?

Follow along in this guide as we go over what you need to know to get on the right track when trading crypto.

Disclosure: Keep in mind that this is not financial advice. We are simply defining the basics of trading. Any trading you do is at your own risk.

What is Crypto Trading?

Crypto trading is another way of saying “buying and selling cryptocurrencies”. You can trade cryptocurrencies using an exchange or a broker.

Cryptocurrency Exchange

A cryptocurrency exchange is an online trading platform that allows buyers and sellers to trade cryptocurrencies with each other. These exchanges make their money by charging transaction fees for each transaction made on their platform, usually in the form of a “buyer’s fee” and a “seller’s fee.”

Cryptocurrency Broker

A cryptocurrency broker is similar to an exchange but doesn’t operate like one. Instead, they provide information about various companies that allow users to trade bitcoin directly with them via an online system, by phone call, or in person.

Now that we understand how you can get started in your crypto trading journey, let’s go over a couple of the different methods and strategies so you can be well on your way to becoming an expert in the field of crypto trading.

Methods of Analyzing Crypto

Would you consider yourself a visually inclined person who can enjoy the thrill of recognizing patterns in charts? Or is making decisions based on the current economy and industry events more your style? Let’s dig a little deeper into these two different methods.

Technical Analysis

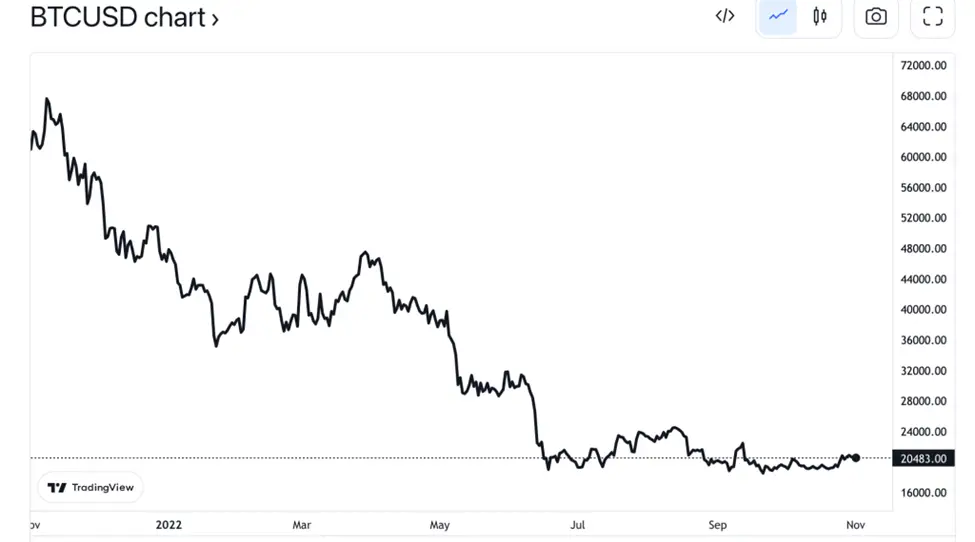

When it comes to technical analysis, the charts that you’ll be analyzing will come from historical price data, which will help you determine the future price of the coin.

A chart that you could consider looking at will be similar to the one below.

The type of decisions you make on a chart like this one will now be determined by the strategy you employ.

Here we will outline day trading, which is a strategy that heavily relies on technical analysis.

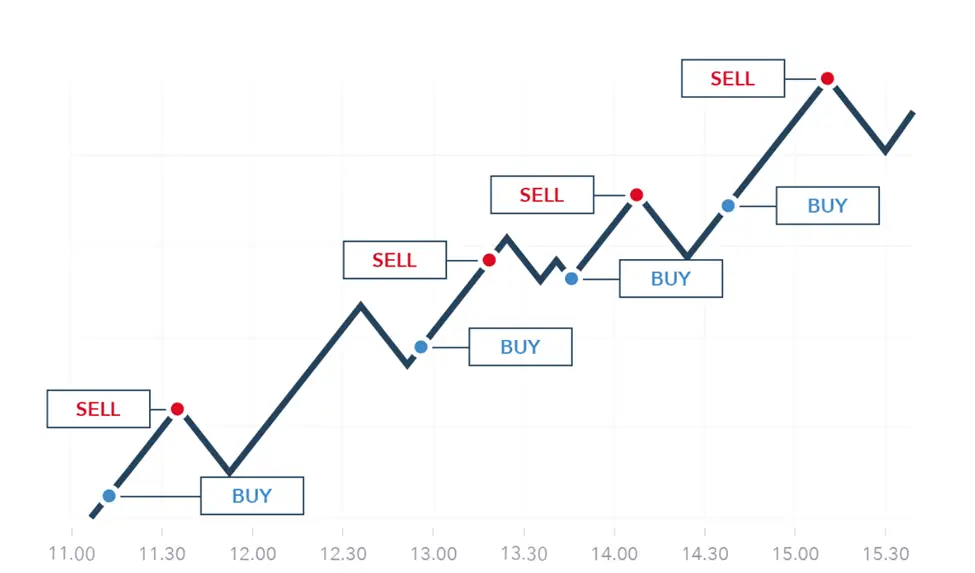

Day Trading

Day trading cryptocurrency entails purchasing and selling a cryptocurrency on the same day. Traders seek to profit from price fluctuations by monitoring prices throughout the day. For example:

A trader buys one bitcoin (BTC) for $20,000 on Monday morning. Then he sells half of his holding when BTC hits $21,000, buys it back when it reaches $22,000, and continues doing so until late afternoon. By the end of his trading session, he would have made a profit if everything went according to plan!

Next up is understanding fundamental analysis.

Fundamental Analysis

Fundamental analysis focuses on a company’s financial health, performance, and the industry it’s in to help determine the coin’s intrinsic value.

The goal of fundamental analysis is to identify coins that are undervalued by the market or have a high potential for future growth. This information is used by investors to make buy or sell decisions on specific crypto coins.

For example:

You might look at whether any new regulations would affect your investment or if there’s been an announcement of a partnership with another company that could increase demand for your coin.

A popular strategy for beginners that uses fundamentals is the following:

Swing Trading

You can see fundamentals along with technical analysis in swing trading, which is a strategy that attempts to capture swings in price over a period of days, weeks, or months.

A swing trader searches for opportunities to enter a position when momentum is going up or exit when it’s going down.

To make this strategy work, you’ll need access to not only current company and industry news, but also historical data on past prices and technical indicators like moving averages, which will allow you to predict future trends with some degree of certainty.

Is trading crypto too risky, but you don’t want to miss out on future gains? If you still have the curiosity to dip your toes into crypto trading with minimal risk, then you’ll find interest in dollar cost averaging.

Bonus: Dollar Cost Averaging (DCA)

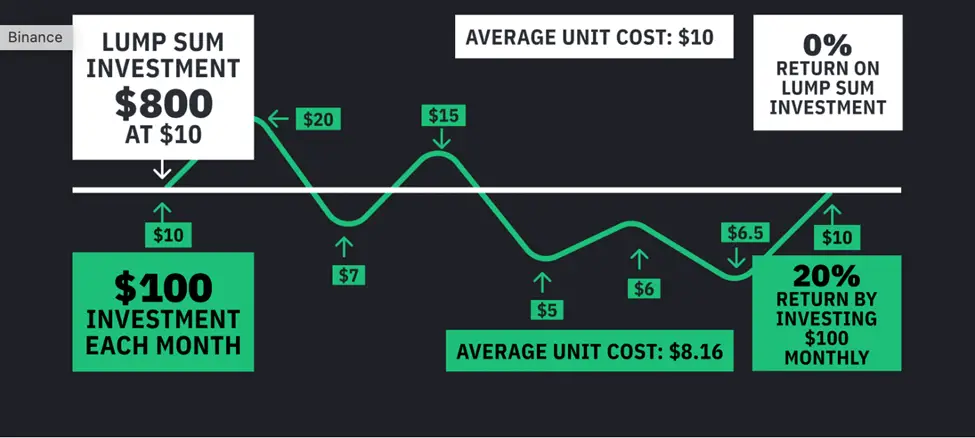

In a perfect scenario, you’d be able to accurately know when to buy. The reality is that even an experienced trader can’t always time the market correctly. To avoid the higher risks associated with other strategies, DCA is an appealing low-risk strategy for beginners.

Dollar cost averaging is a strategy that does not involve either technical or fundamental analysis. Instead, it involves investing a fixed amount of money in a coin or portfolio on a regular schedule. You invest the same amount each time, regardless of the price, which means you buy more crypto when prices are low and fewer when prices are high.

As you can see in the example above, there was a 20% gain on the same investment amount when making multiple purchases instead of taking the whole amount and investing it all at once (which is a good reason to play it safe).

Conclusion

Trading is a skill that can be learned and mastered, just like any other. The first step is research. Find out what kind of trader you are, learn about different strategies and how they work, and then decide which ones best fit the way you want to trade. From there, it’s important to maintain strict discipline when executing your strategy. This means keeping good records so you can see how you’re doing over time and make changes as needed.