What Happens to Debt After 7 Years

Delays in loan repayments lead to an unpleasant situation. The borrower can face serious consequences for not fulfilling his or her obligations. Even if you have missed your payments by just 1 day, this fact will be recorded in your credit history. What’s more, the bank agreement often contains an article about penalties. Each day of delay will cost you money. It can significantly affect the amount of debt.

Nowadays people can get financial support from lenders much easier than it was before. Since the vast majority of lenders approve even a personal loan for unemployed without serious check-ups, the number of borrowers who cannot repay their debt increases. It is the main reason why people start thinking about how to get rid of their legal obligations.

Types of Loan Repayment Delays

Lenders usually react to the delays in payment differently due to their type.

Technical debt

It is a kind of delay in payment that is no longer than 2 days. It may occur in case of money transactions between different banks or technical issues. Lenders are usually loyal to this type of money delay. However, if it happens quite often, banks may not approve your next loan.

Situational Debt

It is a loan delay that is between 10 and 30 days. It usually happens in the case of force majeure. Among possible reasons, there is loss of a job, hospital treatment, decrease in income, etc.

In such situations, lenders usually phone the borrowers to discuss the issue. That is why it is not recommended to ignore the call. If difficulties arise, it is worth settling the problem, determining the repayment period, and clarifying the amount to be paid.

More Serious Delays

If your debt on monthly payments exceeds 30 days it may be considered as a reason for contacting the client by the collectors. They have the right to contact the borrower and the co-signer by phone, travel to his or her place of residence, and send messages to remind a borrower to repay the accumulated debt. Such late payments seriously affect the credit history of the borrower.

If you have been ignoring your monthly payments for more than 3 months it may lead to the early debt collection through the court. As you can understand, the bank has the right to require the borrower to pay the full amount of the loan, taking into account missed contributions, interest, and penalties. What’s more, overdue payments over 90 days make it nearly impossible to have trouble-free loan approval in the future.

What Will Happen With My Debt After 7 Years

The topic of financial borrowing is relevant to many people nowadays. According to a recent study, the Covid-19 led to a radical increase in the unemployment rate and, consequently, the popularity of lenders.

No wonder, people talk about loans a lot. Sometimes it can even result in the appearance of some myth. The most widely spread one is that if a borrower won’t pay off the loan within 7 years, it will be annulled. If you think that this notion sounds strange, don’t be so skeptical.

There are a lot of people who believe that it is possible to get rid of debt in such a way. To manage your finances wisely you should constantly improve your financial education and learn to detect misinformation. It is exactly what we are going to do now!

You should understand that all your financial activities are fixed and analyzed by the appropriate services. If you miss repayments regularly and for a long time, be ready to face consequences! Just imagine you have forgotten to pay on time for a student loan or missed the payday of the medical debt. Even such little things are recorded into your loan history and lower your financial score.

7 years is a point that most borrowers can’t wait for. Exactly after this period, the borrower’s credit history may improve. It happens because previous negative items, like the information about some judgments, unpaid tax liens, etc get erased. However, it works so only with repaid financial obligations.

When a borrower can’t repay the loan for a loan period, he is likely to default. It doesn’t mean that your debt disappears. On the contrary, information about your evasion maneuvers will be sent to a collector agency.

Sometimes the debt collector simply acts as an agent on behalf of the lender. This person strongly reminds you to repay the loan. And sometimes a collector can buy up your debt. After it, this person may try to recover the overdue debt in his or her favor.

You should not be afraid of legal collectors. They do not intimidate the borrower. You won’t be forced to repay the loan at any cost. Collector will help you find possible ways to repay your debt and resolve the issue.

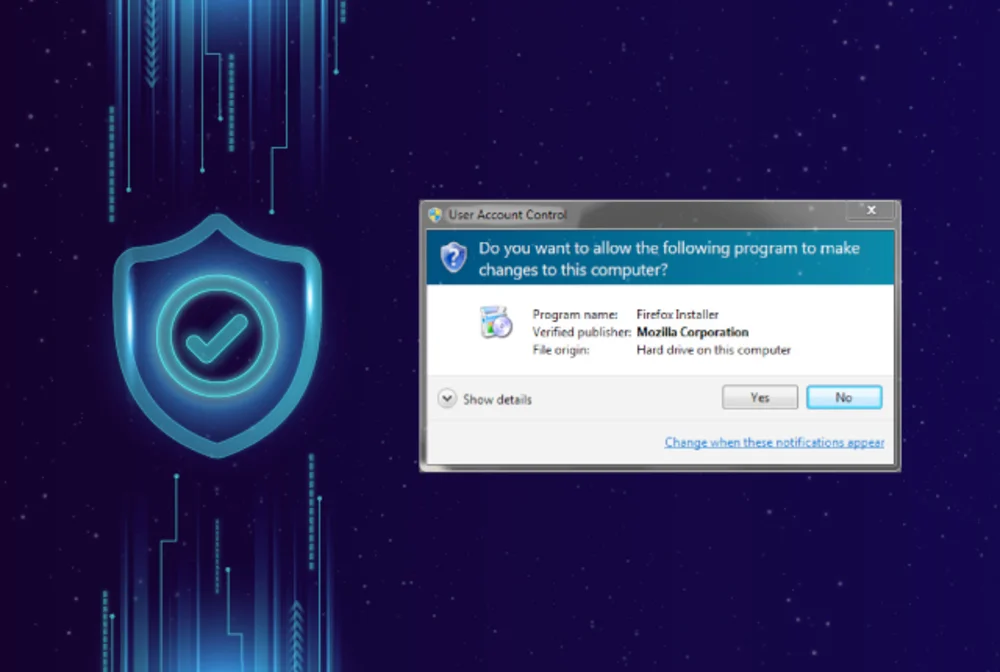

Attention!

A lender can engage only one collection agency. If a collector calls you, and the official letter has not yet arrived, the first thing you should do is to check whether it is a scammer. Due to current legislation, only a representative of a collection agency included in the state register can contact you to deal with overdue debts. However, you can refuse to communicate with this person until you receive an official notification.

Final Thoughts

The notion that after 7 years your debt will erase is a myth. If you take a loan, you are obligated to pay it. What’s more, after this period information about your debt will be transmitted to a collector agency. The pressure on you will increase considerably. The same will happen with the sum of money you owe to the lender. That is why we recommend you to pay off your loan regularly without delays.

But for those who want to take a loan, we have good news. To get financial assistance from a lender you must have a high credit score and excellent credit history. If you have some negative items there, check when they appeared. When 7 years pass, they will automatically fall off.