The Best Way to Achieve Your Long Term Financial Goals

Which Is The Best Way To Achieve Long-Term Financial Goals

Setting short- and long-term financial targets is an essential step toward becoming financially stable. To avoid situations when you have to claim, I need $100 now and search for suitable lending options to cover their urgent costs. If you don’t set aside a portion of your monthly income, you are likely to spend more funds than you earn.

Then you may end up having too much debt and be stuck in an endless debt cycle. If you are tired of feeling financially vulnerable and unprepared to deal with emergencies, it’s time to take some steps and shape your life in order to fit the possible changes.

Goal setting starts with proper financial and retirement planning. It gives you a chance to review your targets, check the progress, and update the goals if necessary.

You should formulate your goals and take some time to set them properly so that you know what you are willing to achieve from short-term to distant. It will help you reduce monetary troubles, live comfortably within your financial means, and save for a comfortable retirement.

How Many Americans Don’t Save Enough

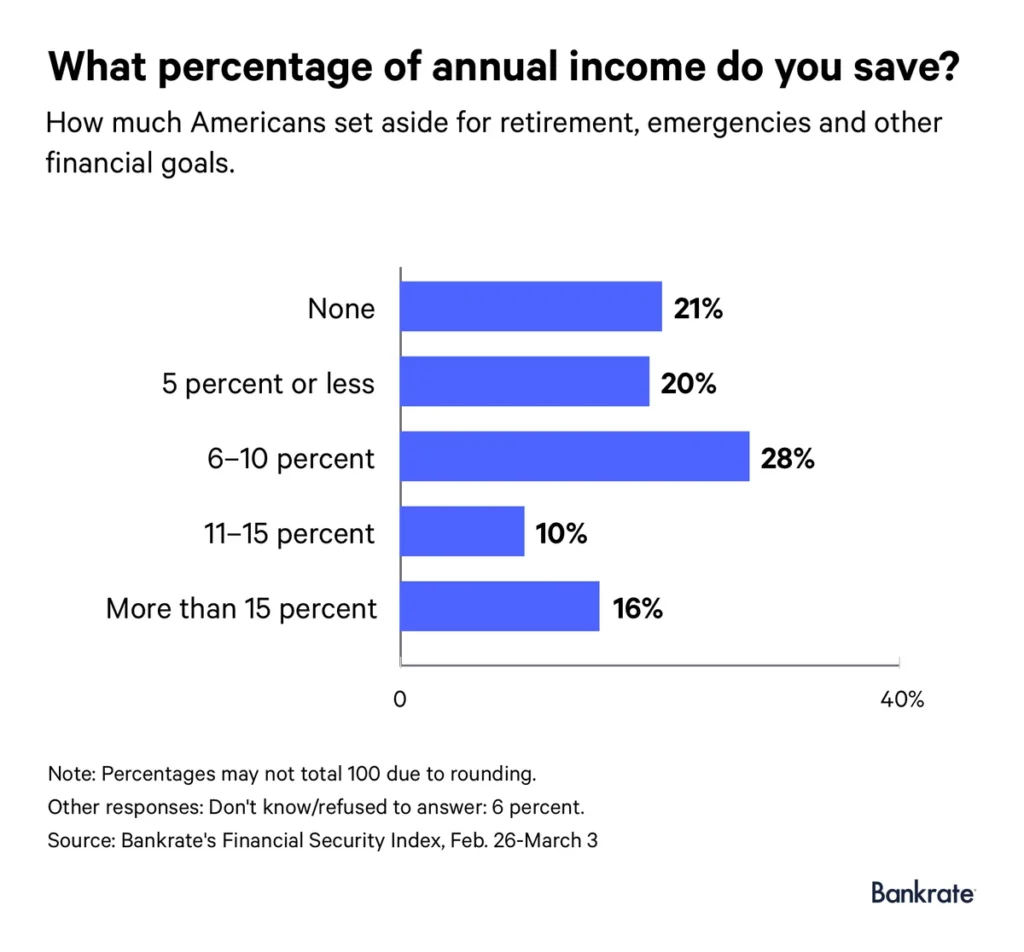

Working Americans are struggling with short- and long-term savings: more than one in five (21 percent) don’t save any of their annual income, according to a recent survey. It means they don’t set aside any cash for emergency expenses, retirement, and other long-term financial goals.

These are the common long-term financial goals examples but the rest of the respondents also don’t save much. Twenty percent of the consumers save only 5 percent or less of their income, and twenty-eight percent save up to 10 percent.

Researchers at the Stanford Center on Longevity claim that those who want to retire at the age of 65 and maintain their standard of living should put 10 to 17 percent of their current income into their retirement account. You will be able to achieve this goal provided that you begin saving at 25.

Generally, financial experts notice that Americans aren’t saving enough. In fact, the younger generation is having a hard time making regular savings. Millennials and Gen Xers mention they aren’t setting aside any cash.

The main reasons why consumers can’t save enough to stay on track for long-term financial goals are emergency expenses, debt, and irregular income. No doubt modern life is more expensive and big-ticket items like housing, child care, or college have risen. At the same time, salaries haven’t increased enough to cover all the essentials.

How to Set Long-Term Financial Goals

It may be challenging to set aside some funds for the future, but the longer you postpone this decision, the further behind you will be. The major long-term financial aim for most people is saving funds to retire. Which is the best way to achieve long-term financial goals? Here are the most effective strategies to help you get started:

1. Estimate Your Retirement Needs

The first step is to estimate your retirement readiness and needs. What are your desired annual living costs during retirement? You will need to establish a budget to have an idea of how much funds you need each month and how much you can comfortably set aside.

Then, subtract the income you obtain and make sure you include pensions and Social Security. You will get the sum you need to be funded by your investment portfolio. Finally, calculate how much you need to have for the desired retirement date.

You should base your retirement assets on what you are having and save now annually. It is useful to do this math with the help of a retirement planning financial advisor that will assist you in better planning and managing your finances.

2. Establish a Budget

Setting up a monthly budget is essential for every consumer who wants to achieve near- or long-term financial targets. It allows you an opportunity to understand where you are at the moment in terms of personal finances.

Every financial planner and advisor will tell you about the importance of creating a budget. You may take advantage of free budgeting tools like You Need a Budget or Mint and track your monthly spending.

This strategy will allow you to have all your accounts in one place and track your spending categories to see what expenses can be lowered to maximize your savings. An old-fashioned way of making a budget is collecting your bills and bank statements for several months and using a paper or a spreadsheet to categorize all expenses.

3. Begin As Soon As Possible

Another important way to achieve your monetary targets is to start saving and investing your funds as soon as possible. The earlier you begin, the more money you will save due to the power of compound interest.

For example, if you start saving at the age of 23, you will need to set aside about $14 per day to become a millionaire at 67 provided the average annual investment return is 6 percent. If you start saving and investing later, you will need to increase your daily or monthly contributions to reach the same figures.

4. Automate Your Savings

Furthermore, it’s important to automate your savings as soon as you start making them. This is an easy way to ensure a certain portion of your income is sent directly to your emergency fund, retirement account, or any other saving account.

You don’t spend much time and effort as everything is done automatically for you. It’s a great option for learning how to live without this portion of your paycheck and making these contributions regular and effortless.

Conclusion

In conclusion, it’s important to have a particular strategy if you are willing to reach your financial goals. Whether they are near- or long-term targets, it is essential to be self-organized and motivated. If you set aside some cash only once, you won’t see the difference.

Besides, any surplus money you get – whether it is a birthday check, a side gig, or a bonus – make sure you send it straight to your savings to maximize them. Don’t get tempted to spend this extra cash, if you deposit it straight away your aims will be achieved faster.